appreciating your wine, guarding its emotions

Wine as an asset

Diversify your portfoliowith fine wine

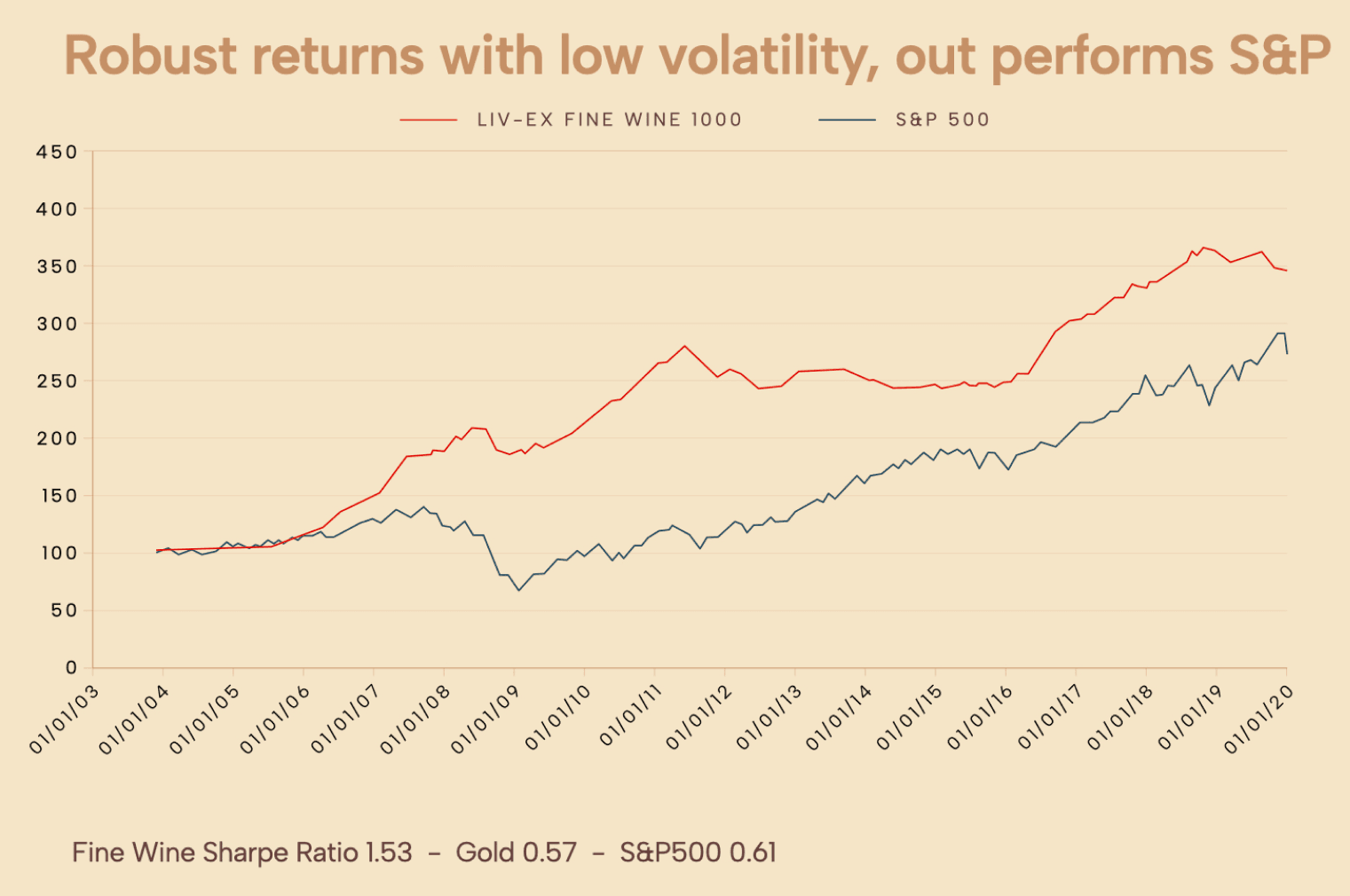

10 years. 120% increase.

That’s been the history of fine wine as an asset. While investing in wine carries risks, just like other investments, history proves it has the potential for substantially high returns.

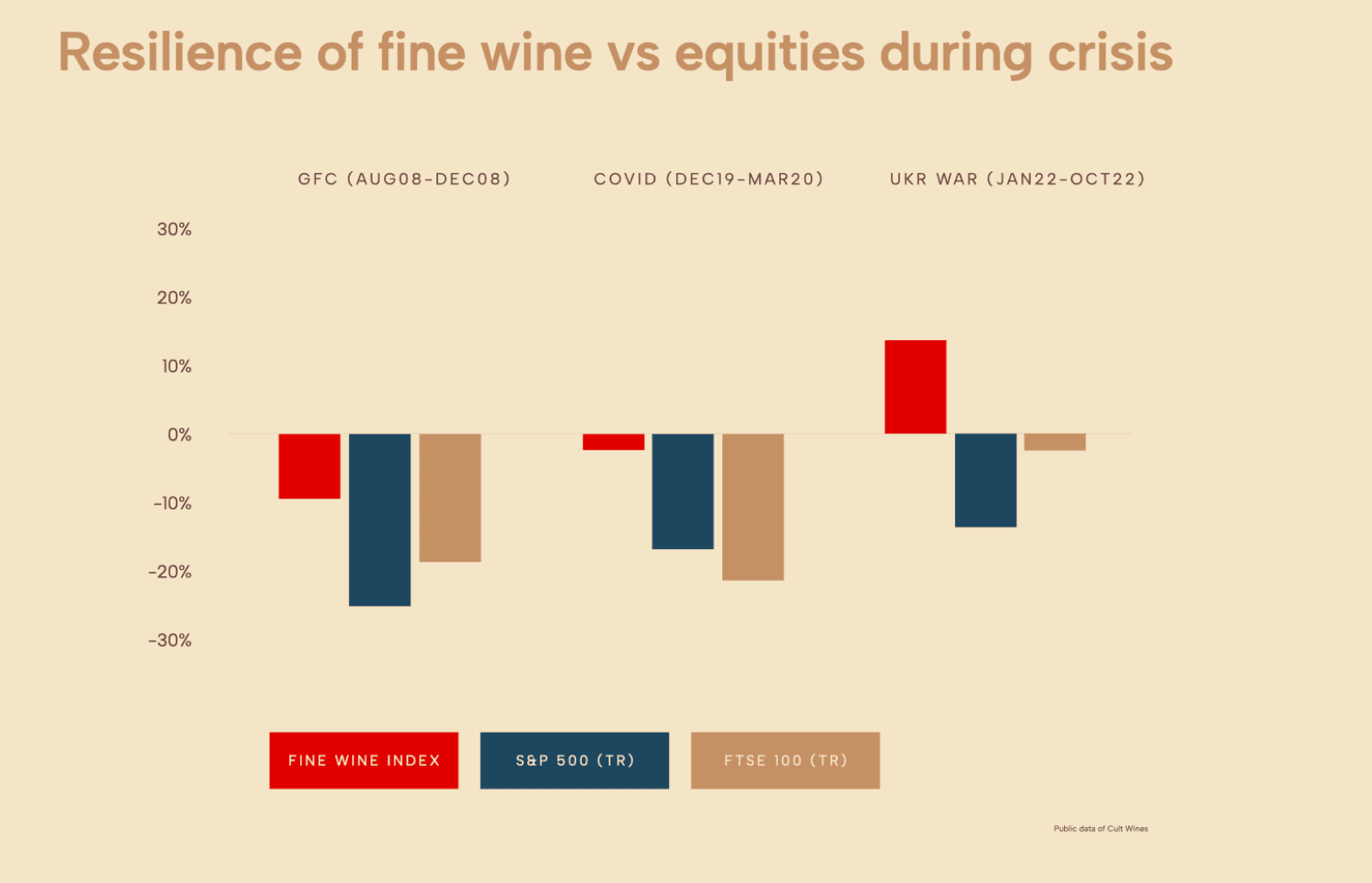

Fine wine value grows over time as it matures and becomes rarer. It has shown consistent positive performance over long periods and is resilient during economic downturns. That has been the historical performance of fine wine as an asset class (2010-2020).

Wine as an asset comes with benefits that investors love

The investment landscape is full of possibilities, from traditional stocks and bonds to alternative assets such as real estate, precious metals, and even art. One such alternative asset that's been garnering growing attention is fine wine. For many, wine is a passion, an indulgence, and a symbol of the good life. But increasingly, it is also being viewed as an investable asset, which can also convey unique emotions whenever the investor finally turns into a consumer.

Inflation resilience

Historically, when inflation increases the prices of goods and services, the value of wine tends to rise in tandem, thus fighting the effects of inflation.

Sustained global demand, scarce supply

The natural laws of supply and demand have a significant impact on the unique performance of wine as an asset.

Low correlation with traditional markets

While stock markets can be highly unpredictable and unstable, fine wine as an asset maintains steady returns during market downturns and through recessions.

Why fine wine is a unique investment asset class

“

Buying shares in a company is risky: management can fail,

reputations can be damaged, and competitors can disrupt its

entire business model.

Wine, on the other hand, is blissfully simple. Once bottled and

reviewed by critics, you already know enough to significantly

minimise your risk.

Jason Zweig

“

Start your wine investing journey with Vinesia

Let us help you add this unique asset to your portfolio.Learn more about wine & art investment

Be the first to know

Join our newsletter and stay up to date with the latest releases and developments at Vinesia